Global Trends are Driving Manufacturing Back to American Shores.

Can it Last?

– Greg Ip, The Wall Street Journal

This statement could not be more true for the current state of American manufacturing but this dynamic appears to be changing. The real question to be asked is why, over the last twenty plus years, have U.S. companies moved the bulk of their manufacturing operations overseas and why do these manufacturing operations now seem to be returning to America?

The answer is multifaceted but the offshoring trend coincided, in part, with the admission of China into the World Trade Organization (“WTO”). China was approved to enter the WTO in 2001 and the prevailing notion was that China would become more tightly integrated into the global economy and, open its markets to the world.

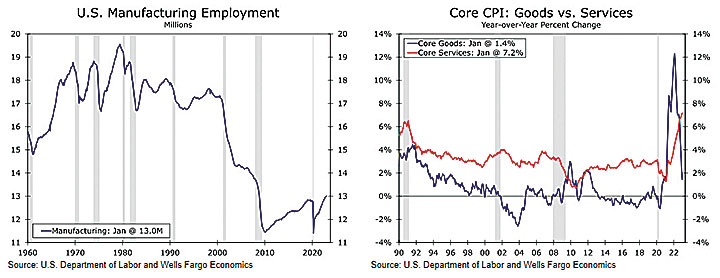

What happened? The entry of China to the WTO enabled the U.S. and other nations to gain access to lower cost labor which changed the economics of manufacturing. In other words, because of the lower labor costs in China, U.S. consumers paid lower prices for certain goods. The downside, however, was that the U.S. domestic manufacturing base began to crumble and experienced further dislocation to Asia. The chart below on the left highlights the drop in U.S. Manufacturing Employment from this shift.

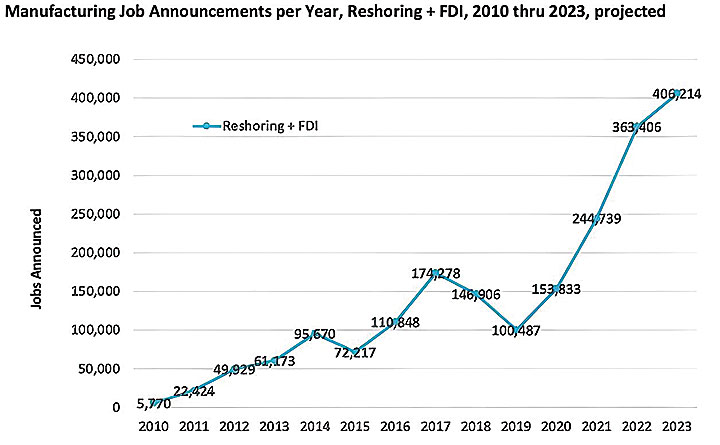

Fast forward to 2024 and we are seeing a rebound in American manufacturing. The “reshoring” movement initially began after the “Great Financial Crisis”, gained steam post COVID-19 as global supply chains were disrupted and remains strong today. The reshoring shift is partly responsible for the strong U.S. employment metrics and has become a tailwind for domestic GDP. Over the past decade it is estimated that we’ve added close to 1.5mm new jobs with no discernible signs this trend ending any time soon.

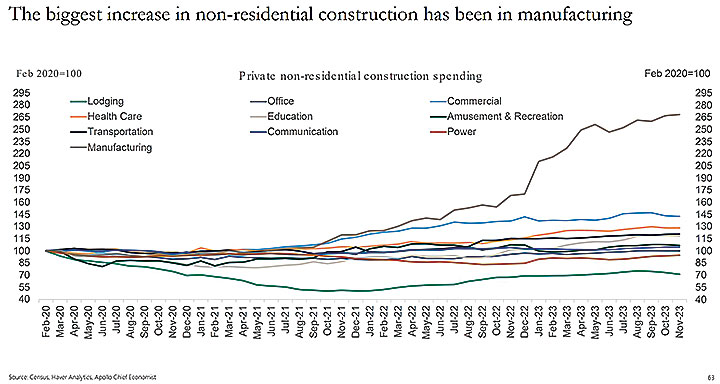

U.S. companies are better innovators and allocators of capital. The rise in construction of manufacturing facilities and the state of the art equipment added to those facilities has helped generate higher productivity levels and made U.S. manufacturing competitive with most other countries.

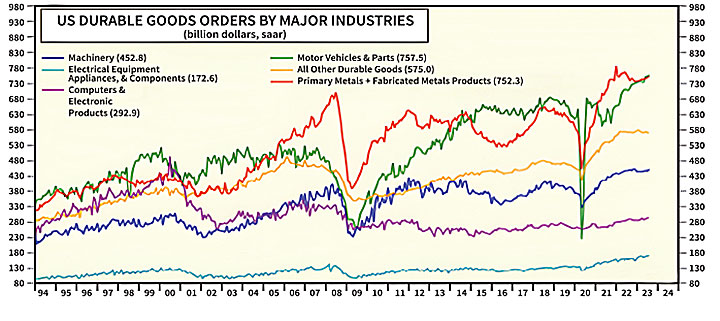

Recent strides in U.S. manufacturing capabilities have helped to close the cost gap versus goods produced in China. In fact, a survey conducted by the Boston Consulting Group estimated that it is 2% to 3% cheaper today to make goods in the U.S. than in China. A major factor in this analysis is the narrowing wage gap between the U.S. and China. Chinese manufacturing wages have risen over 187% in the last decade while U.S. manufacturing wages increased only 27% over the same time period.

Other factors contributing to this dynamic include (1) the increased automation in U.S. manufacturing facilities which has led to productivity gains, (2) shorter supply chains (and therefore, lower shipping costs) and (3) increased Innovation (R&D budgets have increased across all sectors as a direct result of tax breaks and other incentives provided by the U.S. government and engineers and manufacturers are working more closely). The passage by Congress of the Jobs Act in 2021, the CHIPS and Science Act in 2022 could infuse up to $550 billion into the domestic economy in the coming years.

The “reshoring” movement initially began after the “Great Financial Crisis”, gained steam post COVID-19 as global supply chains were disrupted and remains strong today.

The last point on innovation and capital allocation is greatly under appreciated. If we were to use the capital markets as a proxy for the health of the economy, we have seen an average annual return for the S&P 500 over the last 15 years of 9.76% vs. the 2.31% average annual return for the ACWI (i.e. rest of the world ex-USA). The disparity in these return metrics is explained, in part, by the fact that U.S. companies are better innovators and allocators of capital. The rise in construction of manufacturing facilities and the state of the art equipment added to those facilities has helped generate higher productivity levels and made U.S. manufacturing competitive with most other countries. In fact, U.S. productivity growth was 3.9% in 2019, 2.4% in 2020, 1.9% in 2021 and 4.7% for the first 3 quarters of 2023.

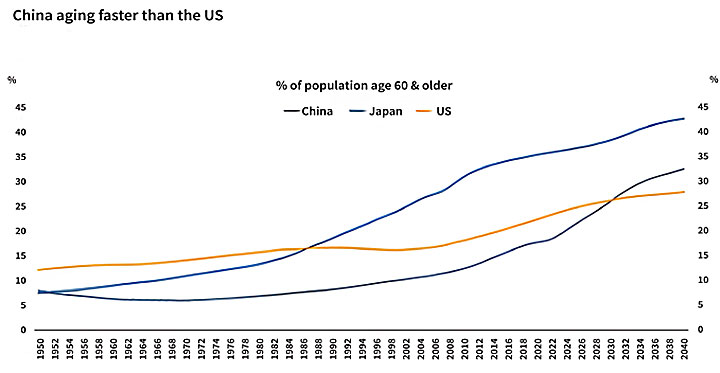

American manufacturing now compares favorably to places like China and it’s worth noting that China could face a major demographic issue in the coming years as it could lose ~100mm workers as a result of the government’s “One Child” policy. The loss of this labor pool could drastically impact China’s ability to compete economically. Conversely, India and Africa, have increasing populations and inexpensive labor but have substandard infrastructure and institutional challenges.

A last wrinkle to consider in the U.S. reshoring trend is the trade barriers put in place during the Trump Administration and maintained by President Biden. Part of the rationale for these trade barriers was to level the proverbial economic playing field as it was alleged that China dumped products into the U.S. markets at prices that made it unprofitable for U.S. companies to compete. U.S. tariffs combined with the re-shoring trend has enabled the U.S. to level the economic landscape.

Our local economy has benefitted from recent “reshoring” trends as distribution facilities have sprouted up in and around the Route 84 NYS Thruway corridor.

Covid-19 also helped to accelerate many of the reshoring trends. When China shut down, the U.S. was not able to procure the goods and products it needed which kick started our spiraling inflation. In its recent survey, the consulting firm, Kearney, indicated that 47% of manufacturing executives said they had re-shored operations to the U.S. with an additional 29% acknowledging that they had decided to bring back some operations within a few years. Another consulting firm, McKinsey, announced in a survey from April of 2022, that 44% of the respondents were “regionalizing” their supply chains. These moves by domestic manufacturers are a direct result of China’s increased adversarial actions.

It is worth noting that our local economy has benefitted from these recent “reshoring” trends as distribution facilities have sprouted up in and around the Route 84 NYS Thruway corridor. Anecdotally, an Orange County based corrugated box manufacturer recently began to upgrade and expand its manufacturing capacity by over 40%. The expansion will add roughly 50 new jobs and help support distributors in the region.

In closing, we should not forget that the U.S. has the rule of law, limited government regulation, and low-cost transportation and is protected by the largest military in the world. It is for these reasons that significant investments have been made to rebalance costs and increase productivity which should enable the recent uptrend in manufacturing and employment to continue.