NEWS, RULES, REGULATION AND LEGISLATION

THE MANUFACTURING ECONOMY

U.S. Manufacturing Activity Regains Speed; Faces Supply Disruptions From Russia-Ukraine War

U.S. manufacturing activity picked up more than expected in February as COVID-19 infections subsided, though hiring at factories slowed, contributing to keeping supply chains snarled and prices for inputs high.

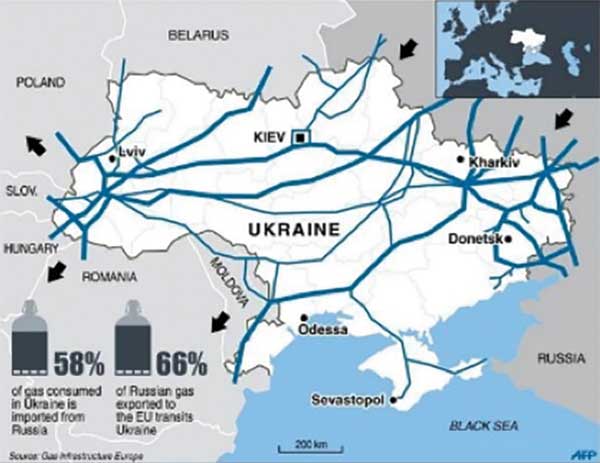

The survey was, however, conducted before last month’s invasion of Ukraine by Russia, which some economists say could further choke supply chains, and especially worsen the shortage of semiconductors. The conflict has caused a surge in oil and wheat prices, among other commodities. Russia and Ukraine are producers of key materials used to manufacture semiconductors.

Producer Price Index Rose By 10%, a 40 Year High

The headline Producer Price Index was up 10% from a year ago, tying January for the biggest gain ever. The index rose 0.8% in February, slightly lower than the 0.9% Dow Jones estimate. Wholesale gasoline prices surged more than 14%, helping feed the biggest single-month increase for final demand goods prices ever in data going back to 2009.

The data came during the week of Feb. 13, before the Russian invasion of Ukraine. Energy prices surged even more as the war began, and will show up in next month’s report. The numbers come with most other inflation gauges running around 40-year highs, thanks to price increases that have spread beyond volatile gas and grocery prices and across a broad spectrum of consumer goods and services.

Empire State Manufacturing Survey Headline:

General Business Conditions Index Falls Fifteen Points, Optimism Remains Strong

Manufacturing activity declined in New York State for the first time since mid-2020, according to the March survey. The general business conditions index dropped fifteen points to -11.8. Twenty-four percent of respondents reported that conditions had improved over the month, while 35 percent reported that conditions had worsened. Firms were generally optimistic about the six-month outlook. The index for future business conditions climbed eight points to 36.6. Longer delivery times, higher prices, and increases in employment are all expected in the months ahead, and capital spending plans remained firm.

- The new orders index fell to -11.2.

- The shipments index moved down to -7.4, pointing to declines in or ders and shipments.

- The unfilled orders index came in at 13.1.

- The delivery times index climbed eleven points to 32.7, pointing to a substantial increase in delivery times.

- The index for number of employees dropped nine points to 14.5, pointing to a modest increase in employment levels.

- The average workweek index moved down to 3.5, indicating a slightly longer workweek.

- The prices paid index edged down three points to 73.8

- The prices received index rose two points to a record high of 56.1.

Cost of Imports Increased in February

The cost of imported goods, including oil, grains and autos, increased 1.4% in February. Import prices rose 1.9% in January. The consecutive month increase is the largest in 11 years. The rise in import prices can largely be attributed to a significant jump in oil prices. The cost of oil rose 8.1% in February, though prices are currently trending down. After rising to nearly $130 a barrel after Russia’s invasion of Ukraine, it is now down to about $100. Export prices increased 3% in February, the highest ever recorded. Exports are up 16.6% over the past year.

Moving forward inflation is likely to remain high through the spring with supply chain delays and Russia’s invasion of Ukraine driving up prices for many important commodities.

Last month the Federal Reserve announced the first increase in interest rates in four years.

Moving forward inflation is likely to remain high through the spring with supply chain delays and price increases.

U.S. Goods Trade Deficit Hits Record High, Will Weigh on Q1 GDP Growth

The U.S. trade deficit in goods widened sharply to a record high in January amid an increase in imports as businesses continued to replenish depleted inventories. Trade has been a drag on gross domestic product for six straight quarters.

The goods trade deficit jumped 7.1% to an all-time high of $107.6 billion last month. Imports of goods increased 1.7%, led by food and motor vehicles. There were also large increases in imports of industrial supplies, capital and consumer goods. Imports of other goods, however, tumbled 15.3%. Exports dropped 1.8%, weighed down by consumer goods, motor vehicles, food and other goods. But exports of capital goods and industrial supplies increased.

Federal Reserve Raises Key Rate a Quarter Point, Says There Will be as Many as Six More Hikes in 2022

The Federal Open Market Committee, the panel of Fed officials responsible for setting monetary policy, increased the federal funds rate by 0.25 percentage points to a range of 0.25 to 0.5 percent. The FOMC also projected roughly six more rate hikes this year, along with slower growth and higher inflation. New projections show most officials expect the fed-funds rate to rise to at least 1.875% by the end of this year, to around 2.75% by the end of 2023 and to hold rates there in 2024.

In a statement following its two-day meeting, the Fed hinted at rising concern about inflationary pressures. It said inflation has been high due to “broader price pressures” and added that the war in Ukraine and “related events are likely to create additional upward pressure on inflation.” The statement also signaled that the Fed could soon announce and implement a plan to shrink its $9 trillion asset portfolio. The central bank ended a long-running asset-purchase stimulus program last week.

Manufacturing Labor Productivity Falls While Factory Orders Decline

Manufacturing labor productivity continued its ongoing slide during the fourth quarter, according to the Bureau of Labor Statistics. Manufacturing labor productivity fell 0.8% in the fourth quarter at the annual rate, extending the 2.6% decline in the third quarter.

- Output rose 4.8% in the fourth quarter, continuing to reflect solid growth in demand for goods despite ongoing challenges with supply chain and workforce issues.

- However, real hourly compensation decreased 4.5% in the fourth quarter, pulling the headline figure lower.

- Unit labor costs for manufacturers increased 4.2% in the fourth quarter.

- For the year, manufacturing labor productivity increased 3.1%, the strongest annual increase since 2010, another year with strong rebounds in activity.

- Labor productivity for durable goods increased 0.8% in the fourth quarter, with output rising 3.9% but with real hourly compensation declining 3.8%.

- At the same time, labor productivity for nondurable goods decreased 3.7% in the fourth quarter, with output jumping 5.7%.

- But with real hourly compensation dropping 5.1%. Unit labor costs for durable and nondurable goods rose 3.3% and 6.7% in the four th quarter, respectively.

Supply and Demand – Electric and Gas Bills Rise Dramatically

According to the U.S. Energy Information Administration (EIA), the average retail residential electricity price increased by 4.3% in 2021 to 13.72 cents per kilowatt-hour (kWh), its fastest rate since 2008. “We forecast that residential retail electricity prices will continue to rise in 2022, although at a slightly slower rate,” EIA researchers wrote. “In 2022, we expect the average nominal price will increase by 3.9% to 14.26 cents/kWh.”

A natural gas supply crunch has made it more expensive for utility companies to buy or produce electricity. Those prices are then passed on to consumers. The cost of natural gas delivered to power plants averaged $4.98 per million British thermal units, more than double the cost in 2020. Even before Russia invaded Ukraine, natural gas had seen a great deal of volatility. Domestic prices reached the highest levels in years ahead of winter as exporters shipped record amounts overseas, including to Europe.

ENVIRONMENT SAFETY AND HEALTH

OSHA Hikes Penalty Amounts

In January, the Occupational Safety and Health Administration (OSHA) announced a 5% increase in the civil penalties assessed for violations of its regulations, but worse may yet come if certain legislative reforms are adopted by Congress.

As of Jan. 13, the maximum penalty for willful or repeated violations rose to $145,027, a nearly $10,000 increase from the 2021 maximum for the same violations. The maximum penalty for failure-to-abate violations increased to $14,502 for each day after the abatement deadline where no abatement has taken place. The maximum penalty allowed for serious, other-than-serious, and posting requirements violations is now $14,502, representing an increase of nearly $1,000 above the maximum amounts that had been adopted last year.

The Climate Action Council’s Climate Transition Cost Analysis, Hearings Scheduled

A climate law adopted by the State Legislature in 2019 requires that New York transition to alternative energy sources on an aggressive time line. At the time of its adoption, no cost benefit analysis of the legislation was performed. Only on October 14, 2021 was the Climate Action Council, the entity charged with drafting a scoping plan for its implementation, presented with a cost-benefit analysis that attempts to quantify the impact of transitioning to a carbon-neutral economy in New York State. The analysis finds that the transition will cost $280-$340 billion, while producing $420-$430 billion in benefits.

The analysis, however, appears to be based on unrealistic targets, to ignore substantial costs to be borne by New Yorkers, and to overstate the benefits from decarbonizing. Hearings on the Act are scheduled to take place across much of the state (not in the Hudson Valley) beginning April 5, 2022.

OSHA ETS Voided by Supreme Court, Agency Presses on with COVID Permanent Vaccine Mandate Rule

When OSHA announced on Jan. 25 that it had withdrawn its COVID-19 vaccine mandate in the wake of the Supreme Court defeat, it may have seemed to many that the ruling had settled the vaccine issue—but that assumption couldn’t be more wrong. On Jan. 26, the agency reported that it would continue to press ahead with developing a permanent rule designed to accomplish the same goals as the ETS it was forced to withdraw following the High Court defeat.

In order to issue a General Duty violation, OSHA must prove there is a recognized hazard that poses the risk of death or serious harm, and that a feasible means of protection exists, points out Charles Palmer, a partner with the law firm of Michael Best & Friedrich. The recognition and “feasible” means of protection are generally identified in industry consensus standards or other guidance documents.

ADVOCACY

Tax Relief for New York State Pass-through Entities

The Council of Industry and the Manufacturing Alliance of New York have called on our elected state officials to include a zero percent corporate franchise tax rate for all manufacturers. Since 2014 the zero % rate has applied to only manufacturers that are “C” corporations. The majority of manufacturers in New York are small-to-medium sized manufacturers organized as S corps, proprietorships, LLCs and/or partnerships (passthrough entities).

When HV Mfg went to press the State Budget had not been enacted, and the passthrough provision was still part of ongoing negotiations between the Governor and legislative leaders.

Manufacturers Unveil Landmark Campaign to Close Gender Gap in Workforce

The Manufacturing Institute, the workforce development and education partner of the National Association of Manufacturers, announced their “35×30” Women’s campaign, an ambitious, industry-wide effort to close the gender gap in manufacturing. By 2030, the “35×30” campaign will work to close the skills and talent gap in manufacturing by adding half a million women to the industry, increasing women’s representation in manufacturing from 29% today to 35%.

The campaign will also lead a nationwide movement designed to change perceptions by engaging face-to-face with emerging leaders and young women students, leveraging more than 1,000 women mentors and collaborating with manufacturers on strategies to attract and retain female talent and broaden the pipeline by supporting women throughout their education.

LABOR, EMPLOYMENT AND WORKFORCE DEVELOPMENT

Job Openings Hold Above 11 million, Quits Decline Slightly

Total vacancies actually dipped a bit, falling to 11.26 million following a substantial upward adjustment in December’s numbers, the Bureau of Labor Statistics’ Job Openings and Labor Turnover Survey showed. That still left job postings 4.75 million above the total counted as unemployed for the month.

Along with the slight decline in openings came a decrease in quits, or workers voluntarily leaving their jobs. Quits declining to 4.25 million, a drop of 3.4% and the lowest number since October. As a share of the labor force, the quits rate declined to 2.8% from 3% the previous two months.

Study: Majority of Workers Who Quit a Job in 2021 Cite Low Pay, No Opportunities for Advancement

Some interesting survey data on the “Great Resignation” from the Pew Research Center. We know from government statistics that the U.S. quit rate is at a record highs—with at least 4 million people leaving their jobs in each month since July 2021. But why are they leaving? Below are the top five reasons, according to Pew:

- It is about money. 37% of those surveyed gave “pay was too low” as a “major reason” they left, and 26% more said it was a “minor reason.”

- Opportunity for advancement was cited by 33% as a major reason and 30% as a minor reason.

- Respect. Feeling “disrespected at work” was a major reason for 35%, and a minor reason for 21%.

- Childcare issues. That was a major issue for 24%, and a minor issue for 24%.

- Not enough flexibility to choose when to put in working hours. A major issue for 24%, and a minor issue for 21%.

The January 2022 unemployment rate for the Hudson Valley Region is 3.6 percent. Year -over- year in January 2022, the labor force decreased by 1,300 or 0.1 percent, to 1,126,100.

Hudson Valley Unemployment Rate Drops to 3.6 Percent in January, Labor Force Down Year on Year

The January 2022 unemployment rate for the Hudson Valley Region is 3.6 percent. It is up from 2.8 percent in December 2021 and down from 6.1 percent in January 2021. In January 2022, there were 40,500 unemployed in the region, up from 31,300 in December 2021 and down from 68,300 in January 2021. Yearover-year in January 2022, the labor force decreased by 1,300 or 0.1 percent, to 1,126,100.

- Putnam County 3.3 percent

- Rockland County 3.3 percent

- Dutchess County 3.5 percent

- Orange County 3.7 percent

- Ulster County 3.7 percent

- Westchester County 3.7 percent

- Sullivan County 4.1 percent

US DOL is Pushing for Unions

There is a concerted effort by the White House to make sure that workers are supported as they try to organize. Over 20 government agencies are working with the White House Task Force on Worker Organizing and Empowerment to promote the administration’s support for “worker power, worker organizing and collective bargaining.”

On Feb. 7, 2020, the Department of Labor issued specific recommendations including:

- Ensuring workers know their organizing and bargaining rights.

- Protecting workers who face illegal retaliation when they organiz e and stand up for workplace rights.

- Establishing a resource center on unions and collective bargaining.

- Shedding light on employer’s use of anti-union consultants.

- Collecting and reporting more information on unions and their role in the U.S. economy.

- Advancing equity across underserved communities by supporting worker organizing and collective bargaining.

SEC Proposes Publicly-Traded Companies Disclose Emissions, Climate Risk

The Securities and Exchange Commission proposed a new rule Monday, March 21, that would require large businesses to issue regular reports on greenhouse gas emissions caused by their operations and possible climate-related financial risks. The proposed rule would require relevant businesses to disclose three different “scopes” of greenhouse gas emissions.

Scope 1 emissions are those caused directly by a company’s own operations—carbon dioxide from a steel mill, for example. Scope 2 emissions are those indirectly caused by purchasing energy from a greenhouse gas-producing source, like electricity from a coal-powered energy plant, and Scope 3 emissions are those caused indirectly in a company’s value chain, including energy sold to another business.

The rule is currently being made available for public comment. If taken up, it could take effect between 2024 and 2026, according to information published on the SEC’s website. The French news agency AFP noted that the emissions-reporting proposal is similar to efforts taken by regulators in Japan and Europe.

Collaborative Recruiting Initiative Enters 3rd Year of Matching Job Seekers to Hudson Valley Manufacturing Jobs

The Council of Industry’s Collaborative Recruiting Initiative (CRI) is a platform to help Hudson Valley manufacturers fill employment vacancies. Council of Industry uses the iCIMS Applicant Tracking platform to help members post jobs on major job boards as well as on our own site www.HVMfgJobs.com.

Participating companies get all the advantages of an applicant tracking system plus the added benefit of collaborative promotion of jobs. With more than 100 great jobs posted representing a wide range of manufacturing occupations and trades from entry level to professional, production to back office, CRI has helped participating companies fill hundreds of positions since its inception in 2019.